A guest blog from Iain Stark, international HR leader and reward expert, on the future of executive pay post COVID19.

Executive compensation, especially CEO pay, is often a flashpoint, especially in times of a crisis, economic or social, and Covid-19 is both.

While this could be viewed as a niche issue at this terrible moment, there is also a broader story here as the actions of individual businesses and their leaders collectively impact society across the world. Firms along with their Remuneration Committees and Boards will be asking themselves whether they are doing the right thing during a pandemic affecting everyone.

There is a lot of scepticism, especially after what happened to CEO pay since 2008. Salary cuts in 2020 may get headlines, but with the majority of compensation for most senior executives being from bonuses and long-term plans, as makes sense, this should be the focus as suggested by this recent article in the Financial Times – “Bumper CEO stock awards dwarf salary sacrifice”. What messages are they sending to all stakeholders about their principles and practices, is it fair including what is happening across their workforce, and what should they do going forward? What further considerations does the outcry across the world about what happened in Minneapolis add, especially for what senior executives are rewarded?

This article offers thoughts drawing from what is happening in the three countries in which I have lived and worked, the UK, the US and France. We are just at the beginning. The expectation is that Covid-19 will remain with us, better controlled (new behaviours, vaccines), but still there and with the risk of further waves.

There are four questions that those who set executive pay should consider in the context of this new world:

1. Short-term or longer-term impact? – Immediate tactical reactions have included the 25% compensation reduction recommended by the association for large businesses in France (Afep) while the state is paying partial unemployment benefits (including some CEOs going further), foregoing salary or bonuses as some CEOs in the US have done, notably from industries most heavily affected, and similarly in the UK. This is an opportunity to revisit the sustainable strategy for the longer term – it can’t change every few months. And this is true for all sectors, not only those which have been hit hardest in the past four months.

In 12-18 months will we be back to what would have happened anyway?

– Salary cuts restored

– Annual bonuses at the same levels or higher as Boards reward CEOs for survival action.

– Long-term incentives based on the same metrics (with reduced targets? – see Question 4), with some rebalancing, i.e., increased weighting on Environmental, Social, Governance (ESG ) components, a trend that was already evident across all three dimensions, and for the social dimension are there any new elements or targets to add relating to diversity beyond the very active actions that some have been taking for years. Into this strategy and design comes how to avoid windfall gains versus true performance payments as share prices recover.

2. Will it be different this time – lessons from history? While the depression in the 1930s is often referenced for economic impact, more recent crises in a globalized world may offer more direct lessons – the 1998 crisis in Asia, SARS, H1N1 and the 2008 financial crisis. The bursting of the dotcom bubble, while not strictly a crisis, had crisis-like effects for some.

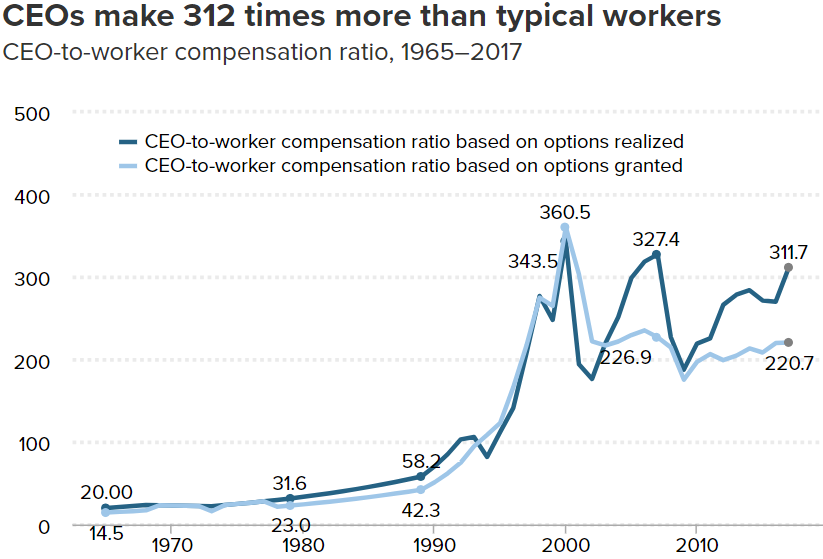

History (chart here from the Economic Policy Institute: US data) shows some bumps in CEO pay but then recovery each time.

But the underlying support of continual economic growth in China throughout this period should not be underestimated. GDP in US$ terms increased 10x from 2000. This support will not be there this time.

For many the first three of the four crises felt distant and the hope was that Covid-19 would be the same. The financial crisis in 2008 was more global, albeit hitting the financial sector hardest. Progressively in the following decade there were new regulations (Dodd-Frank in the US in 2010), new guidelines (European Shareholders’ Rights Directive), new disclosures (CEO pay ratios in many countries) and greater shareholder input (say on pay, with varying binding impacts on policy and especially on actual payouts). The impacts are debatable. Covid-19 has hit faster and across almost all sectors.

For many the first three of the four crises felt distant and the hope was that Covid-19 would be the same. The financial crisis in 2008 was more global, albeit hitting the financial sector hardest. Progressively in the following decade there were new regulations (Dodd-Frank in the US in 2010), new guidelines (European Shareholders’ Rights Directive), new disclosures (CEO pay ratios in many countries) and greater shareholder input (say on pay, with varying binding impacts on policy and especially on actual payouts). The impacts are debatable. Covid-19 has hit faster and across almost all sectors.

3. Think globally or locally? Even for the most international of multinationals the historic focus is local when it comes to executive pay. That this is where filing requirements apply is clear but there are opportunities to learn globally and then adapt and apply at home and in other markets. Leaders will look, act and communicate globally.

4. What rewards changes to consider and whether to make them now for 2020? Business strategies and targets that seemed reasonable only four months ago are being discarded. For some visibility may be improving but mostly to confirm that it will be a different business environment with challenging prospects. For others the outlook is unclear. So, what is the right balance for each individual business between reaction in 2020 and setting a sustainable foundation that can be adjusted in the future?

In the next few months Companies, Remuneration Committees and their Boards need to decide and communicate the following, probably at the latest in Q3 by when the results of the first half of the 2020 financial year are known:

– Is there a need to make compensation and benefits changes now? If YES, what and for whom (CEO, other executives, all employees, key populations), which reward plans and is this a short-term patch or a longer-term change in direction? Competitive compensation plans and levels differ by level, role and country, but is there a health and well-being minimum across the whole workforce?

– 2020 Incentives – Annual bonus and sales plans: Continue with the same designs and formulae but with revised targets, or adjust for targeted populations? Often those in corporate pools, including CEOs, are protected versus those on the ground in front of clients, notably sellers for some of whom targets set in 2019 may now be totally unachievable and they may switch off for 2020 and either wait for 2021 or look for outside opportunities. This may be a moment to be sure to avoid this. Any changes to these plans needs to pass the communications “fairness test” internally and externally and deliver the right motivation to key groups of staff.

– Long-Term Incentives: This may be the most complicated decision with the greatest impact on employee motivation and retention and on investor relations. These plans, with three to five-year performance periods, may now be at risk of not paying out for 2020 and perhaps for future years. A key here is plan metrics, for example, total shareholder return versus a benchmark may be ok, as may cash flow management and ESG elements, but absolute growth in revenue or profit may take years to recover. Should targets change, should formulae adapt, should or firms and their Boards stick with what made sense three months ago?

– Retention Plans: Finally, related to the above, is there a legitimate business case for targeted retention actions for individuals who are essential for the future of the business and whose bonus and long-term plans are at risk? If so, what will the optics be for the overall workforce and the public in terms of reasons and fairness and should this include the CEO and the direct leadership team?

While no one knows the answers to these questions, not least in this time of change, companies need to get ready to communicate their policies and underlying principles in the next weeks and months in ways that make sense for their business, their employees, their clients and the societies in which they do business.