Welcome back to work. FTSE100 bosses will have already clocked up an average annual UK salary by lunchtime today.

“Over a thousand pounds an hour…”

“Over a thousand pounds an hour…”

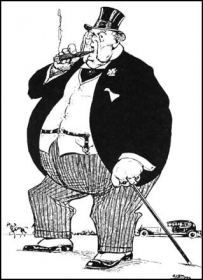

Fat Cat Wednesday 2017

• Top bosses will already have made more money by the first Wednesday of 2017 than the typical UK worker will earn all year

• The average pay ratio between FTSE100 CEOs and the average total pay of their employees in 2015 was 129:1

• Making the publication of pay ratios compulsory will help track progress on closing this gap

It’s Fat Cat Wednesday (4.1.2017). After just two and a half days Britain’s top bosses will have made more money than the average UK worker earns in an entire year, according to High Pay Centre calculations.

The figures show that pay for top company executives returning to work this new year will pass the UK average salary of £28,200 (note 2 below) by around mid-day on “Fat Cat Wednesday”.

After a year in which “elites” were criticised for being out of touch and ignorant about the concerns of ordinary people, these pay gap figures confirm that there are dramatically different rates of pay at the top compared with what everyone else receives.

Median FTSE100 CEO pay in 2015 was £3.973 million (note 1 below). We found that even if CEOs are assumed to work long hours with very few holidays, this is equivalent to a rate of pay of over £1,000 an hour (note 3 below). The “national living wage” for over 25s is £7.20 an hour.

High Pay Centre director Stefan Stern said: “Our new year calculation is not designed to make the return to work harder than it already is. But ‘Fat Cat Wednesday’ is an important reminder of the continuing problem of the unfair pay gap in the UK. We hope the government will recognise that further reform to pay practices are needed if this gap is to be closed. That will be the main point in our submission to the business department in its current consultation over corporate governance reform.

“Reality check” needed

“Effective representation for ordinary workers on the company remuneration committees that set executive pay, and publication of the pay ratio between the highest and average earner within a company, would bring a greater sense of proportion to the setting of top pay,” Stern added.

The huge increase in top pay in recent years seems to have arisen because of so-called “performance-related pay” awards. But as new research from Lancaster University Management School has revealed, the link between pay and performance has in fact been “negligible”:

https://www.ft.com/content/abc7085e-c857-11e6-9043-7e34c07b46ef

This is not just a FTSE100 company problem. AIM-listed Asos is being criticised today by the GMB union for a similar vast gap in pay created by the chief executive’s “Long Term Incentive Plan” (for more information contact jon.parker-dean@gmb.org.uk).

And excessive private sector pay deals set a bad example to some public sector and not-for-profit organisations, as controversy over the pay for some university vice chancellors, school “superheads”, NHS Trust chief executives, local authority leaders and some charity bosses suggests.

The continuing pay gap creates problems for us all.

Ends

Notes:

1. The median pay for a FTSE 100 CEO in 2015 was £3.973 million, based on the publicly disclosed “single figure” measure https://highpaycentre.org/pubs/10-pay-rise-thatll-do-nicely (There are different ways of measuring executive pay, and the single figure measure differs from the “pay realised” figure and the pay awarded figures available from Manifest.)

2. Median earnings for full-time workers in the UK (who had been in their job for at least 12 months) were £28,200 in 2016https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/earningsandworkinghours/bulletins/annualsurveyofhoursandearnings/2016provisionalresults. This represents an increase from £27,645 in 2015.

3. Even when making the generous assumption that FTSE 100 CEOs work 12 hours a day, including three out of every four weekends, and take fewer than 10 days holiday per year, this still works out at about £1,009 per hour, meaning that it would take around 28 hours’ work to surpass the UK average of £28,200 – some time around mid-day on Wednesday 4th, assuming they begin work for the year on Monday January 2nd.

4. The High Pay Centre is an independent think-tank set up to examine corporate governance and pay at the top of the income distribution. We carry out research aimed at developing a better understanding of top rewards, company accountability and business performance.

5.

The 10 highest paid CEOs in 2015 and 2014 were as follows:

| 2015 | 2014 |

| Company | CEO | Total pay £000 | Company | CEO | Total pay £000 |

| WPP | Sir Martin Sorrell | 70,416 | WPP | Sir Martn Sorrell | 42,978 |

| BERKELEY GROUP | Tony Pidgeley | 23,296 | Royal Dutch Shell | Ben Van Beuren | 19,510 |

| RECKITT BENCKISER | Rakesh Kapoor | 23,190 | RELX | Erik Engstrom | 16,176 |

| SKY* | Jeremy Darroch | 16,889* | TUI TRAVEL | Peter Long | 13,333 |

| SHIRE | Flemming Ornskov | 14,638 | PRUDENTIAL | Tidjan Thiam | 11,834 |

| BP | Bob Dudley | 13,296 | LLOYDS BANKING GROUP | Antonio Horta Osario | 11,544 |

| RELX | Erik Engstrom | 10,869 | RECKITT BENCKISER | Rakesh Kapoor | 11,237 |

| PRUDENTIAL | Mikle Wells | 10,031 | HARGREAVES LANSDOWNE | Ian Gorham | 10,608 |

| SCHRODERS | Michael Dobson | 8.905 | EXPERIAN | Don Robert | 9,868 |

| LLOYDS GROUP | Antonio Horta Osario | 8,773 | BP | Bob Dudley | 9,289 |

*The data for Sky show a one year figure within a scheme that pays out biannually, meaning one year “spikes” and the next year reduces significantly.

For further comment/information call Stefan Stern on 07979 694 474 Stefan.Stern@highpaycentre.org