Given the way shareholder returns have increased regularly since the pandemic, It is understandable that the Chancellor is considering increasing taxes on dividends in the upcoming budget. A blog by HPC researcher Paddy Goffey.

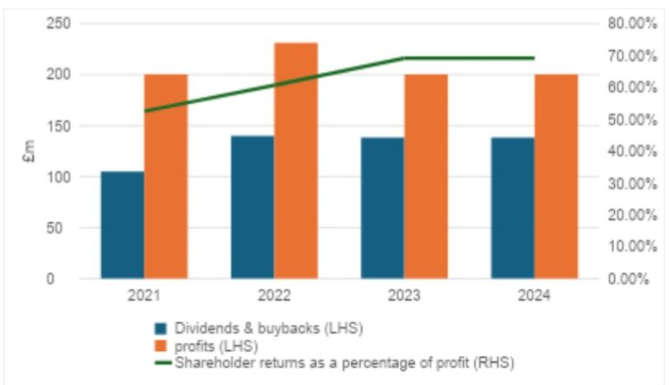

Previous HPC research has shown that the proportion of FTSE100 profits returned to shareholders through dividends and share buyback schemes increased for three consecutive years following the pandemic, reaching almost 70% of total profits. It is understandable, therefore, that the Chancellor is considering increasing taxes on dividends in the upcoming budget.

As the Resolution Foundation have pointed out, roughly doubling the basic rate of 8.75% would raise much needed-tax receipts for the treasury, align the UK with rates seen across Europe and help deter the current “artificial arrangements whereby the timing and amount of dividends is carefully managed each year to stay just below the higher rate threshold, or where shares are split between spouses for tax purposes”.

FTSE 100 shareholder returns as a percentage of profits

While concerns have been raised about the potential impact this may have on smaller businesses, it is clear that share-holders have benefited significantly from return schemes while wages for average workers have largely stagnated. Between 2014 and 2018, for instance, FTSE 100 returns to shareholders rose by 56%, while the median wage for UK workers increased by just 8.8%. Furthermore, in 27% of cases, returns to shareholders were higher than the company’s net profit.

One recent policy idea by Tom Powdrill, Chair of the HPC board, suggests that companies should be prohibited from distributing profits to shareholders unless employee pay has at least increased with inflation. Given the consistent prioritisation of shareholder returns over employee wage growth, this could act as an important first step in addressing the existing imbalance between shareholders and employees, ensuring the latter receive a fairer proportion of the value they help to create.