This year’s CEO Pay Report explores the pay trends in the FTSE 350, and their broader implications for economic equity. A blog by Rosie Neville.

As we navigate the post-pandemic landscape, rising inflation, and a cost of living crisis, sensitivity to inequality and extreme concentrations of income amongst the super-rich is heightened. The report takes a closer look at how executives are compensated in this context.

These are the five key takeaways from this year’s report:

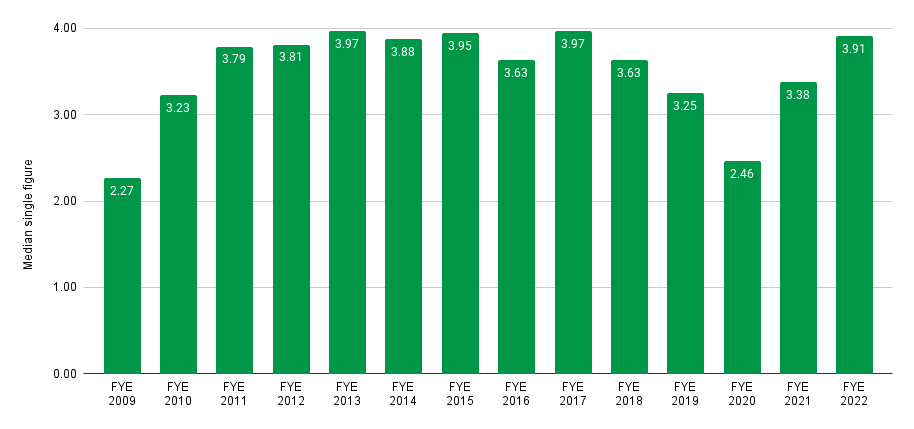

1. Highest CEO Pay Since 2017.

There has been a marked increase in median FTSE 100 CEO pay, which increased by half a million, reaching £3.91 million in 2022. This figure not only represents the highest level since 2017 but also signifies a notable 16% increase from the previous year’s £3.38 million.

It is likely that this increase in pay isn’t confined to just CEOs, and that the pay of the broader senior management, where incentive pay represents a large proportion of their pay, has seen an increase too. Although there isn’t a consistent reporting system in place, preventing an accurate quantification of this broader senior management pay, the aggregate expenditure on executives, including the CEO but also other executive directors, within the FTSE 350 companies exceeded £1.33 billion, across 570 executives.

This amount represents only a segment of the top earners at each company and, as a result, downplays the opportunity cost involved with excessive top pay, in relation to potential alternative uses of this money to boost the pay of the wider workforce, dividends to shareholders, and investment within the business.

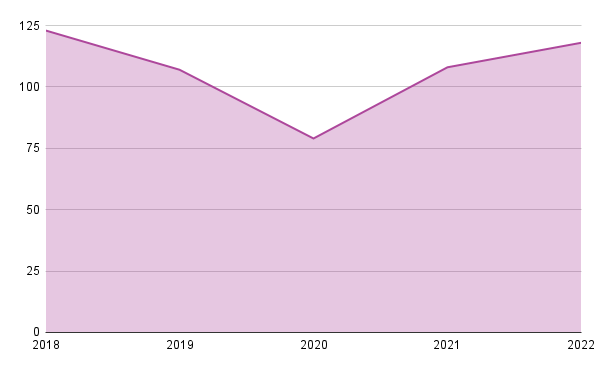

2. Growing CEO-Worker Pay Gap.

While FTSE 100 CEO median pay witnessed a 16% increase, the median pay for full-time workers only grew by 5%. This disparity resulted in a pay ratio of 118:1 between the median FTSE 100 CEO and the median UK full-time worker in 2022, up from 108:1 in the previous year. This trend underscores the persistent challenge of income inequality. This marks the second consecutive year of CEO-Worker pay gap growth, dampening the optimism surrounding an anticipated economic reset post-pandemic that would include curbs on excessive top pay and reduced income inequality.

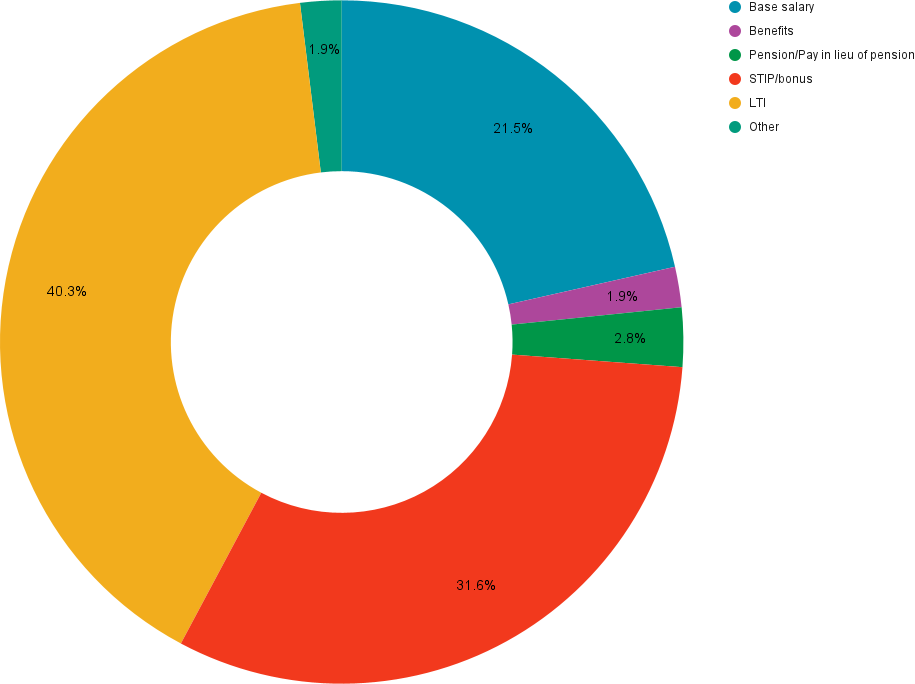

3. Components of CEO pay and changing face of long term incentives.

Unlike the average worker, the majority of CEO pay packages comprise variable components, with 72% of total remuneration stemming from incentive pay such as bonuses and long-term incentives (LTIs). Base salary only represents 21% of pay.

However, in recent years, a number of companies have been switching away from conventional LTIs to Restricted Shares Plan (RSPs). In FYE 2022, five FTSE 100 companies exclusively made their LTI payment in the form of restricted share awards. These companies were Hargreaves Lansdown, HSBC, Lloyds Banking Group, Rolls-Royce, and Weir Group.

Unlike a conventional LTI, where an executive is granted shares that only become available or pay out if specific performance criteria are met in the future, a Restricted Shares Plan entails an executive being granted a certain number of shares if they remain employed. This means Restricted Share Plans largely remove performance conditions from the award thereby making them simpler and payouts more certain.

Among the five companies where restricted shares served as the exclusive component of their long-term incentives, the average restricted share value was £782k. This value is significantly lower than the mean value of conventional LTIs (excluding those entirely comprised of or containing an RSP element), which was £1,835k.

This trend is set to continue as several companies have incorporated a transition to restricted shares in recent remuneration policies.

Owing to their more modest compensation structure, a move towards RSPs could reduce companies’ senior management pay bill. This, in turn could reduce their CEO to worker pay gaps and free up money to spend elsewhere, which in turn could limit the potential for reputational risks and resentment from the workforce towards senior management.

4. Diversity – a Mixed Picture

Diversity amongst executives is important both because it brings varied perspectives, experiences, and decision-making approaches that drive better business outcomes, and also it fosters a more inclusive corporate culture.

The median pay for female CEOs was £3.91 million. This is comparable to the median pay of male FTSE 100 CEOs at £3.96 million.

Despite some progress, such as women occupying 34% of all FTSE 100 Executive Committee and Direct Report positions, there hasn’t been the same progress in CEO roles – with only 8 (of the 97 FTSE 100 companies covered by our report) having a female CEO.

A contributing factor to the sluggish advancement in diversity in top-level positions is probably the low turnover rate, which is understandable due to the attractive pay. Additionally, the CEO job market’s lack of transparency likely plays a role, as a significant number of CEOs positions are not publicly advertised.

5. UK CEOs do not appear to be lowly paid when compared internationally.

Taking an international perspective on CEO compensation unveils notable differences among various nations. These differences are influenced by factors such as company performance, regulatory frameworks, public perception, and shareholder engagement.

On the basis of limited comparisons, taking in account average market capitalisation of indexes, UK FTSE 100 CEOs do not appear to be lowly paid in comparison with the CEOs of comparable companies in other countries.

US and Canadian CEOs can expect higher pay compared to their UK counterparts, whereas CEOs in France, Germany, and Australia can expect relatively lower pay. The characteristics that define a good CEO, how these might be developed and whether they are as unique and irreplaceable as claimed, the importance of individual leaders to business success and that of the wider economy and the extent to which attraction and retention risk actually exist all need to be researched and debated much more extensively before we adhere to the extremely dubious arguments that prevailing executive pay levels should be increased even further.

In summary, this year’s CEO Pay Report underscores several key points regarding CEO pay and its implications for the UK economy and society. As the pay gap widens and income inequality remains a concern, businesses face an opportunity to prioritise fair compensation practices and contribute to a more equitable society. In light of this, the High Pay Centre is calling for reforms to regulations affecting the corporate pay-setting process including:

- Requirements for companies to include a minimum of two elected workforce representatives on the remuneration committees that set pay

- Guaranteed trade union access to workplaces to tell workers about the benefits of union membership and collective bargaining

- Requirements for companies to provide more detailed disclosure of pay for top earners beyond the executives, and low earners including indirectly employed workers, enabling more informed pay negotiations at individual companies and a clearer debate about pay inequality more generally.

- New bodies should be established for unions and employers to negotiate across sectors, beginning with hospitality and social care

- Phasing out long-term incentive payments and replacing them with mechanisms like profit shares, common to all staff ensuring that everyone who contributes towards a company’s success benefits from it.