Our thoughts on proposed changes to executive pay-setting process

Is the current Code requirement sufficient, or should the Code include a “comply or explain” presumption that companies have provisions to recover and/or withhold variable pay?

If Performance-Related Pay is to be used, then obviously clawback ought to be mandatory. Without clawback arrangements, there is an obvious risk that executives will undertake measures that benefit the company in the short-term, enabling them to access generous bonuses and so-called Long-Term Incentive Plans.

Examples might include cutting staff costs, failure to invest in production equipment or neglecting health and safety procedure. It would be exceptionally bad Corporate Governance not to safeguard against this, and if the Corporate Governance Code doesn’t require this, it weakens the credibility of the codeYou can read our more detailed paper on this subject here.

However, the real issue is not whether clawback is applied, but the total quantum of executive pay, and the validity of performance-related pay as a driver of performance. Countless studies have questioned the impact that performance-related pay has on performance. Intuitively, it seems preposterous to think that the type of highly-skilled competitive individuals who reach executive positions would be sitting with their feet up if their pay was not linked to performance. The research on this, from both the business and academic community, is extensive. For example:

- Timothy Judge, Ronald Piccolo, Nathan Podsakoff, John Shawd and Bruce Riche, The relationship between pay and job satisfaction: A meta-analysis of the literature in Journal of Vocational Behaviour, Volume 77, 2010

- PricewaterhouseCoopers, Making Executive Pay Work: The Psychology of Incentives, 2012

- Edward Deci, Richard Koestner and Richard Ryan, A meta-analytic review of experiments examining the effects of extrinsic rewards on intrinsic motivation in Psychological Bulletin Vol 125 No. 6, 1999, p627

You can find a summary of these articles here (p6-7) and here

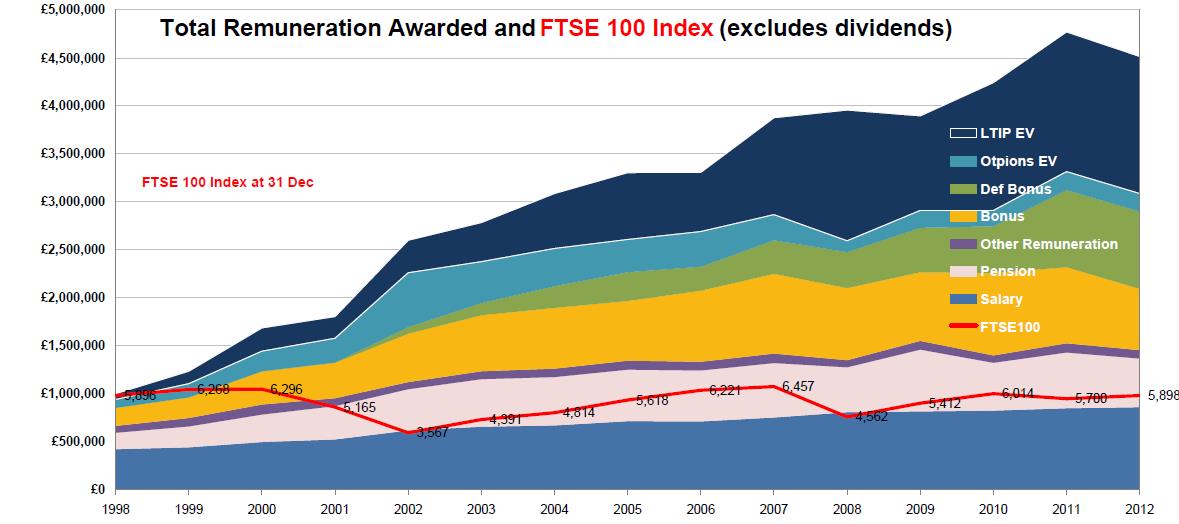

Despite this extensive evidence, the Code continues to endorse Performance-Related Pay, and there is no questioning of the concept by companies. Cynics might argue that this is because it makes executive pay packages more complex and provides a spurious fig leaf for the payment of unpalatable sums of money, by allowing companies to claim that they are linked to performance. However, the below chart demonstrates that this is not actually the case – while performance-related pay has driven a 400% increase in pay For FTSE 100 CEOs over the past 10 years, the value of the FTSE 100 has not hugely increased

Clawback would be a slight improvement on this failed system, but would not change the fact that the Corporate Governance Code does not reflect the considerable doubts cast on the value of performance-related pay

Should the Code adopt the terminology used in the Regulations and refer to “recovery of sums paid” and “withholding of sums to be paid”?

As above – stronger language such as this protects the long-term interest of the company if performance-pay is to be used, but we would prefer it not to be used in the first place

Should the Code specify the circumstances under which payments could be recovered and/or withheld? If so, what should these be?

(With all the previous caveats about performance-related pay)…. Payment of deferred bonuses, LTIPs etc should be contingent on value being delivered not just for shareholders but also for company employees, customers and the economy as a whole. Events that may not necessarily impact on share price – such as the exposure of illegal or unethical behaviours or injury being done to employees because of corporate negligence- do great harm to the standing of UK business. These should also result in the clawback of performance-related pay, not just a collapse in company share price or profitability

Are there practical and/or legal considerations that would restrict the ability of companies to apply clawback arrangements in some circumstances?

The High Pay Centre does not have specific legal expertise, but it is clear that it is incredibly difficult to clawback executive pay. We should therefore acknowledge the very limited role that clawback can pay in assuaging public anger about unfair and disproportionate levels of pay at the top. The High Pay Centre is frequently asked to comment on strong cases for some form of clawback where none has been forthcoming.

See, for example, the Co-Operative Bank. Given the Bank’s recent troubles, it is difficult to imagine a clearer case for clawback. The fact that this has proved so difficult shows that we should expect limited use of clawback provisions – and probably fiercely-contested legal/media battles that are likely to prove damaging to the reputation of UK business.

Are changes to the Code required to deter the appointment of executive directors to the remuneration committees of other listed companies?

Yes, but the biggest problem is not just serving executives who benefit from the high pay culture, but also those with a background at executive level or in the well-paid financial sector. Our report on remuneration committee membershipshows that just 10% of rem com members are drawn from other backgrounds

These people approach the question of executive pay with an executive’s perspective. They almost unanimously subscribe to the idea that executives are unique, irreplaceable talents. They benefit or have benefited from a culture that attributes company success to a small number of individuals at the top, rather than the efforts of the workforce as a whole, nevermind the wider economic context or the transport, education, technological and legal infrastructure, backed by taxpayers, on which companies depend.

As such, we think the corporate governance code should also contain much stronger language about representation on remuneration committees for alternative perspectives and alternative areas of expertise (eg reputational, employee engagement or academic research). Backgrounds the Code could endorse might include company employees; faith groups; NGOs; or academics.

Is an explicit requirement in the Code to report to the market in circumstances where a company fails to obtain at least a substantial majority in support of a resolution on remuneration needed in addition to what is already set out in the Regulations, the guidance and the Code? If yes, should the Code:

- set criteria for determining what constitutes a ‘significant percentage’;

- specify a time period within which companies should report on discussions with shareholders; and/or

- specify the means by which companies should report to the market and, if so, by what method?

Requiring firms to report to the market sends a message to companies that pay is an important issue. The information is also likely to be valued by potential investors given the potential risk to company reputations – and the wider reputation of UK businesses – caused by excessive executive pay.

As companies are engaging with shareholders on pay at an early stage, the likelihood of significant opposition to a pay vote is less likely (though this does not necessarily mean that excess pay is not a problem, simply that well-paid fund managers, usually responsible for other people’s money, do not deem it a problem). As such, the threshold for what night be deemed a ‘significant percentage’ ought to be lower

Are there any practical difficulties for companies in identifying and/or engaging with shareholders that voted against the remuneration resolution/s?

Perhaps, but it is also worth noting that we should not necessarily consider a ‘no’ vote to be a bad thing or a sign of weakness in the company. It reflects an active interest on the part of shareholders. The fact that it takes place in the open is healthy for the company and for debate about how UK businesses are run and how they serve the interest of the wider economy.

Is the Code compatible with the Regulations? Are there any overlapping provisions in the Code that are now redundant and could be removed?

It is worth noting that the code is clearly written and an established-part of the UK Corporate Governance landscape. The regulations are less established and could go ignored. On the basis that ‘prevention is better than cure’ it is probably helpful if the code reiterates the requirements of the regulations

Should the Code continue to address these three broad areas? If so, do any of them need to be revised in the light of developments in market practice?

Firstly, the Code’s requirement that pay should be linked to performance is potentially damaging, and needs to catch up with the evidence showing that performance-related pay serves only to drive executive pay packages upwards, with no benefit for performance. In fact, much evidence suggests that performance-related pay creates perverse incentives can actually have a negative impact on performance.

For further evidence, see the response to question 1.

Secondly, the Code and regulations both now require executives to take pay and conditions across the workforce into account when setting executive pay. Our research shows that FTSE 100 companies currently ignore this requirement. They are also likely to pay lip service to vague references in the new regulations asking companies to consult with the workforce on executive pay. It would be easy, for example, to put a fairly meaningless statement in remuneration reports claiming to have sought updates on worker attitudes from the Human Resources Department.

To ensure companies genuinely relate executive pay to pay across the group, the Code should require companies to publish the pay ratio between their highest and lowest earners. This would provide objective data rather than subjective claims of sensitivity.

This pay ratio should refer to total pay, rather than just base salary. The current incarnation of the code states that companies should be sensitive to pay and conditions across the group when calculating executive pay, especially in respect of ‘annual salary increases.’

When this clause was written, base salary accounted for the majority of executive pay. As the chart in question 1 shows, it is now scarcely 20%. Therefore this reference to ‘salary increases’ should instead refer to ‘total pay.’

Our recent report deals with the failure to comply with these parts of the code, and the likely impact of the new regulations. It can be downloaded here.