The High Pay Centre’s annual review of CEO pay in the FTSE 100 shows median CEO pay jumping from £4.29m to £4.58m in 2024/2025

Our new report shows that the pay of the CEOs of Britain’s biggest companies increased by 6.8% in 2024/25.

- Median pay for a FTSE 100 CEO increased from £4.29m in 2023/24 to £4.58m in 2024/25. This is the highest level of FTSE 100 CEO pay on record, and the fourth successive year that CEO pay has grown. The last three years have all been record breaking

- Mean FTSE 100 pay grew from £5.12 million to 5.91 million – a 15.4% increase and breaks the previous record of £5.79 million set in 2017/2018

The research shows that the median FTSE 100 CEO is now paid 122 times the median UK full time worker, almost the same level as 123:1 in 2023/24

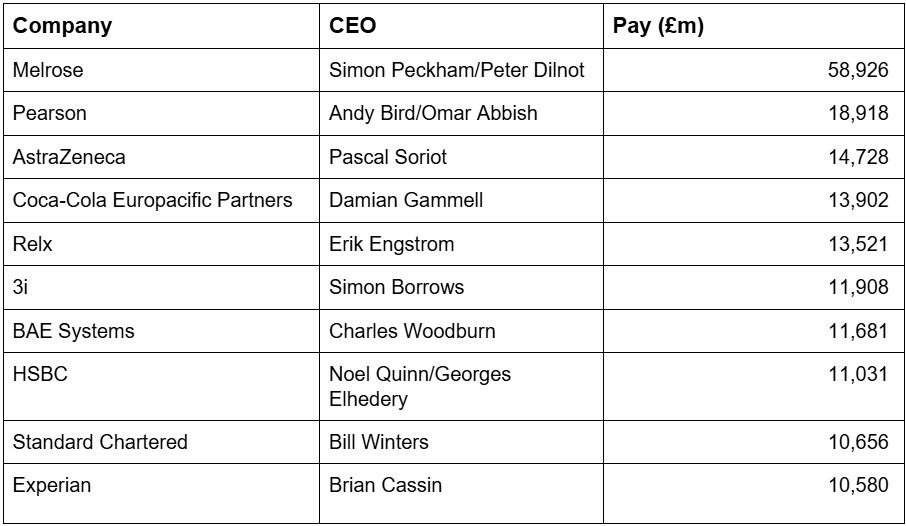

The ten FTSE 100 companies with the highest CEO pay in 2024/25

Other key findings include:

- The number of FTSE 100 companies paying their CEOs £10 million or more increased by 30%, from 10 firms in 2023/24 to 13 firms in 2024/25

- FTSE 100 firms spent £1bn on the pay of 217 executive roles. This represents an increase from £757 million in 2023/24 – however much of this increase reflects executive pay awards at Melrose Industries, where the executives were paid £212 million.

- In 2024/25 84% of FTSE 100 companies paid their CEO a Long Term Incentive Payment (LTIP) up from the 81% who did in 2023/24.The mean LTIP payment increased from £2,008k in 2023/24 to £2,258k in 2024/25.

- In total ten female CEOs served for at least part of the year, with all remaining in post at the end of the financial year. Nine companies had female leadership for the entire financial year, with their median pay amounting to £3.27 million.

- For companies who had a male CEO for the whole financial year, the median pay was £4.64 million – slightly higher than the overall median pay for the FTSE 100.

Our report argues that excessive spending on top earners by leading firms often comes at the expense of pay increases for the rest of the workforce. We are calling for reforms to regulations affecting corporate pay-setting process including:

- Implement the Employment Rights Bill in full, including measures ensuring that workers are informed by employers of their trade union rights, and guaranteeing unions reasonable access to workplaces. Research shows that higher trade union membership and collective bargaining coverage are linked to reduced pay inequality.

- Include worker directors on company boards – A right for workers to elect at least two directors to company boards would improve operational understanding of the business at boardroom level, enhance accountability, and encourage a focus on long-term company success over short-term shareholder profit.

- Reform corporate reporting on pay – even though companies’ annual reports now typically run to hundreds of pages in length, they rarely contain fundamental information on who works for company and what they are paid. Regulations should require consistent disclosure on the pay of top earners beyond the CEO, and greater transparency on pay levels throughout the workforce, including the number of workers paid less than a living wage. If workers, investors and other stakeholders have more transparent information about pay practices, they are likely to be able to influence them to ensure fairer outcomes.