HPC briefing on proposals to remove concept of shareholder primacy from key element of UK compant law

This Friday the House of Commons is scheduled to debate the Company Directors (Duties) Bill, a Private Members Bill proposed by Liberal Democrat MP Martin Wrigley.

The Bill proposes to refine directors’ legal duties as outlined in the 2006 Companies Act. It will remove the clause that effectively means that shareholders’ interests are elevated above those of all other stakeholders – including employees, customers, suppliers and wider society. The Bill will instead state that directors’ have a responsibility to take the decisions that are likely to promote the success of the company for the benefit of shareholders, workers and the environment with no one group’s interests taking precedence over the others.

Unfortunately, because of the limited amount of Parliamentary time dedicated to Private Members Bills, it is possible that there won’t be sufficient time to debate the Bill on Friday and as a Bill led by an opposition MP, the chances of it progressing into legislation are even slimmer.

Nonetheless, Martin Quigley has done valuable work in highlighting this important issue. The changes he proposes would better reflect the reality of the important role that businesses play as employers, corporate citizens and environmental actors, and the complexity of balancing the sometimes conflicting interests of these groups. Generating returns for shareholders fills an important societal function, but when this comes at the expense of paying a fair wage to workers, investing in innovation and productivity or protecting the environment it has damaging socio-economic implications.

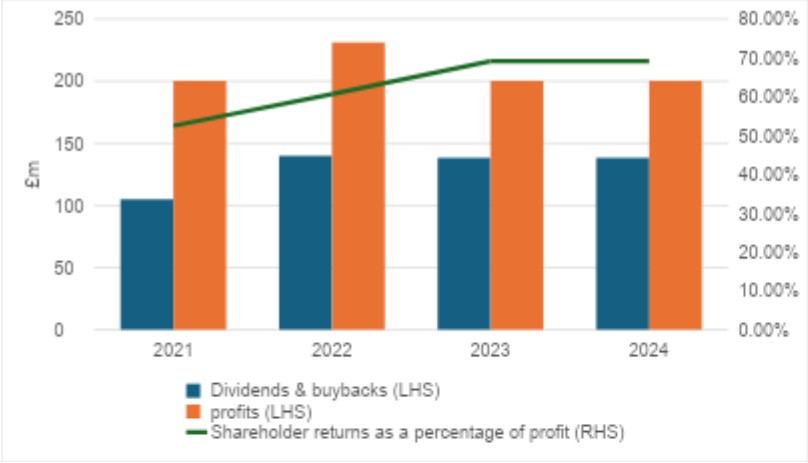

HPC shows that the proportion of FTSE100 profits returned to shareholders via dividend payments and share buybacks has increased for three consecutive years in the aftermath of the pandemic, reaching nearly 70% of profits.

FTSE 100 shareholder returns as a percentage of profits

This is money that could be spent on investment in innovation or productivity or on pay for low and middle-earning workers. There are good grounds to think that the ‘shareholders first’ business culture is a key cause of the stagnation in pay and productivity that the UK has experienced in recent decades.

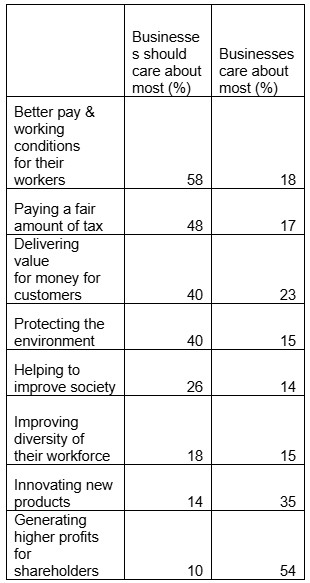

It has also contributed to public suspicion and distrust of business. Previous High Pay Centre polling found that 54% of the public think that businesses care most about generating returns for shareholders, while just 18% think they care most about providing better pay and jobs for their workers. When it comes to what people think businesses should care about, the proportions are almost exactly reversed. 58% of survey respondents think they should prioritise pay and working conditions for their workers while only 10% think generating returns for shareholders is most important.

Public attitudes to business priorities

Reforming directors’ legal duties would send an important message about the purpose of business and its relationship to society. It would provide a basis for business leaders to think differently when contemplating holding down pay or cutting investment to fund another big pay-out for wealthy investors. Even if the private members’ bill fails to progress beyond this week, MPs should continue to press for this sensible and necessary policy change.