Report by The Open University, University of Nottingham, Western University and the High Pay Centre think tank examines the corporate response to Covid-19

According to our latest research in collaboration with the Open University, the University of Nottingham and Western University, fewer than half of Britain’s leading businesses cut executive pay in response to the economic shock of Covid-19.

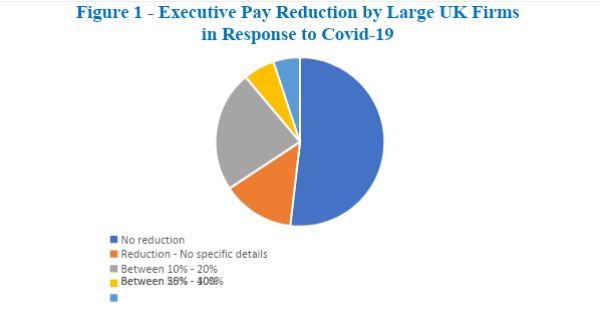

The researchers analysed statements to the stock market between March and May 2020 at the outbreak of the pandemic by 216 non-financial companies with a market value of over £500 million. Just 104 firms took at least one measure to cut executive pay. 78 of these firms cut base salaries or cancelled pay rise, while 29 reduced or cancelled bonus payments.

A salary reduction of 10-20% was the most common measure taken (by 50 firms), while only 11 firms reduced salary by more than 50%.

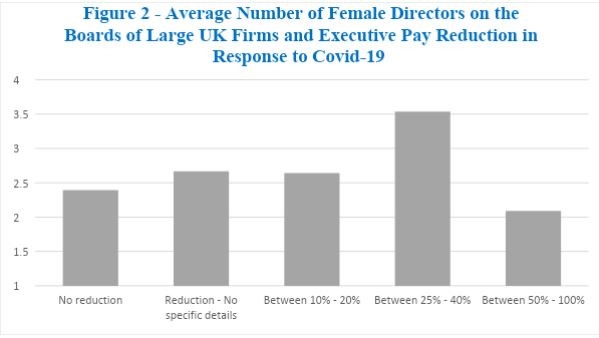

The research also found that firms with more female directors and higher proportions of share ownership by institutional investors were more likely to cut executive pay.

Firms cutting pay on average have more female directors on their boards. Those that cut pay by 25-40% (the most common action) had an average number of 3.5 female directors on their board, compared to just over 2 female directors for those that made no reductions. After controlling for factors such as firm size, leverage, sector, board size and the level of pre-Covid executive compensation, the analysis found evidence of an association between female board representation, institutional ownership and executive pay cuts in response to Covid.

Many firms announced that cutting pay for their executives during the pandemic was a key way to demonstrate solidarity with lower-earning workers, and/or to control costs at a time of considerable uncertainty.